KIVA ZIP

Innovative Microfinancing To Turn Dreams Into Reality

Kiva Zip needed help verifying, supporting, and increasing the volume and repayment rate of its 0% interest crowd sourced loans.

We utilized existing internal and external community resources to completely redesign

their product offerings and digital interface.

PROBLEM

Kiva Zip needed an overhaul of their loan verification and repayment process so their non-traditional lendees could:

-

Get loans easily and quickly

-

Reduce loan application fulfillment time

-

Increase the volume of loans being fulfilled

-

Support small businesses and entepreneurs

-

Increase loan repayment from 87% to 100%

SOLUTION

We amended their 1x1 trustee to applicant system to a crowd sourced, social verification system

-

Increase access and support to Kiva Zip's community and lenders and knowledge

-

Increase the successful rate of loan repayment

-

Increase volume of loans fulfilled

-

Shorten loan approval time

-

Created a marketing and small business plan that is the application

KIVA ZIP CASE STUDY

Kiva Zip is a company that prides itself on bringing 0% interest crowd sourced loans to entrepreneurs, small business owners, and non-traditional loan applicants doing social, environmental, and personal good in the world.

Their then system required that a single trustee be linked to every prospective loan applicant to assist the applicant in navigating the Kiva Zip loan application and loan acquisition process. The trustee would act as a liason betwen Kiva Zip, the lenders, and owner, as well as give mentorship and support in the launching and running of the proposed business. This 1x1 trustee to entrepreneur support would ideally lead to successful businesses and loan repayment. But there were some problems with this model.

PROBLEM

-

More loan applicants than trustees therefore limiting the amount of loans that could be fulfilled.

-

Difficulty finding enough people that have the time, knowledge, and personal motivation to mentor, advise, and act as trustees to potential loan applicants

-

Raise the current repayment rate of 88% to 100% which would be more likely to occur with more successful Kiva Zip entrepreneurs and businesses.

How do we increase loan volume and repayment while supporting non traditional lenders with a limited amount of time, resources, and money?

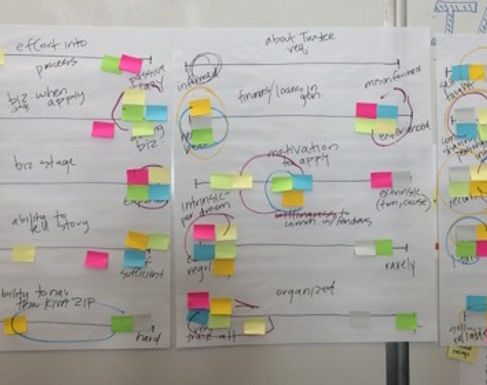

RESEARCH HIGHLIGHTS

We were able to gain a real visceral understanding for the goals and struggles of Kiva Zip’s small business and loan applicants through a thorough a thorough in-person interview process.

PAIN POINTS:

-

Lack Of Small Business Management, Knowledge, Experience, And Resources

-

Lack Of Knowledge In Developing Organizational, Fiscal, Marketing Plan/Materials

-

Not Enough or No Community Mentors/Support

-

Lack of Knowledge on Where/How to Get Support and Assistance

-

Difficulty Planning, Meeting, & Managing Business Obligations

-

Too Overwhelmed to Access and Execute Help and Suggested Business Strategies

SYNTHESIS & PERSONA DEVELOPMENT

All this results in very excited and well meaning small business entrepreneurs who are under equipped, unprepared, or unsure how to plan, manage, and stay on top of their loan, small business, and marketing needs.

Interview themes reflected user goals:

-

Wanting to receive interest free loans

-

Wanting assistance in navigating the Kiva Zip system and obligations

-

Wanting assistance in the strategy and execution of fiscal, business, and marketing plans from preparation launch and throughout business life cycle

-

Individual needs and motivations for each applicant

Our research led us to the development of two main personas:

Small Business Owner & The Power User

SOLUTION

The research very pointedly indicated that people were excited to start their businesses and had good intentions of paying off their Kiva Zip loans on time but were often times overwhelmed with the scope of starting and maintaining a business and could not keep up with the demands of both the business as well as their Kiva Zip obligations.

Research showed that one of the most important factors between successful and unsuccessful loan applicants is an active and knowledgeable trustee to guide them through the process.

-

Why not crowd source knowledge and resources from the Kiva Zip community

-

Make the loan application process the business and marketing plan

-

Develop a co-op driven social verification system to lend to in site and community support, marketing, oversight, and credibility

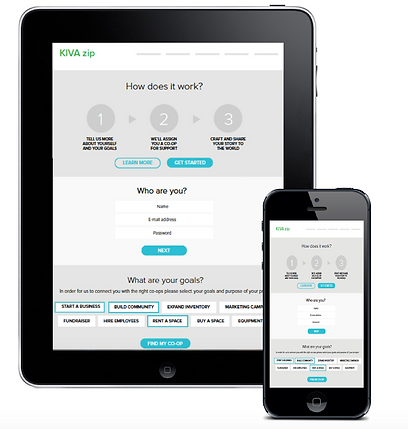

The co-op concept gives the opportunity for anyone with in the Kiva Zip community to seek and receive industry or small business assistance from other knowledgeable members (owners, lenders, trustees) so that the applicant can move forward with in the Kiva Zip loan process as quickly as possible, while simultaneously developing an actionable business and marketing plan, and being reviewed and verified by the cooperative members for the successful launch, maintenance, and repayment of their business and loans.

Kiva Zip Co-Op

WIREFRAMES